Insights into Steel Industrial Transformation with Crick Waters

Key takeaways:

- There is now a shift from trying to predict rare events to ascertaining where, across an entire plant, additional attention of the maintenance and reliability team is required.

- Beyond basic PdM, quality and cost-reduction have become priorities. So has sustainability.

- Success with smart manufacturing requires scaled implementation of advanced analytics and user-driven adoption of the AI solution.

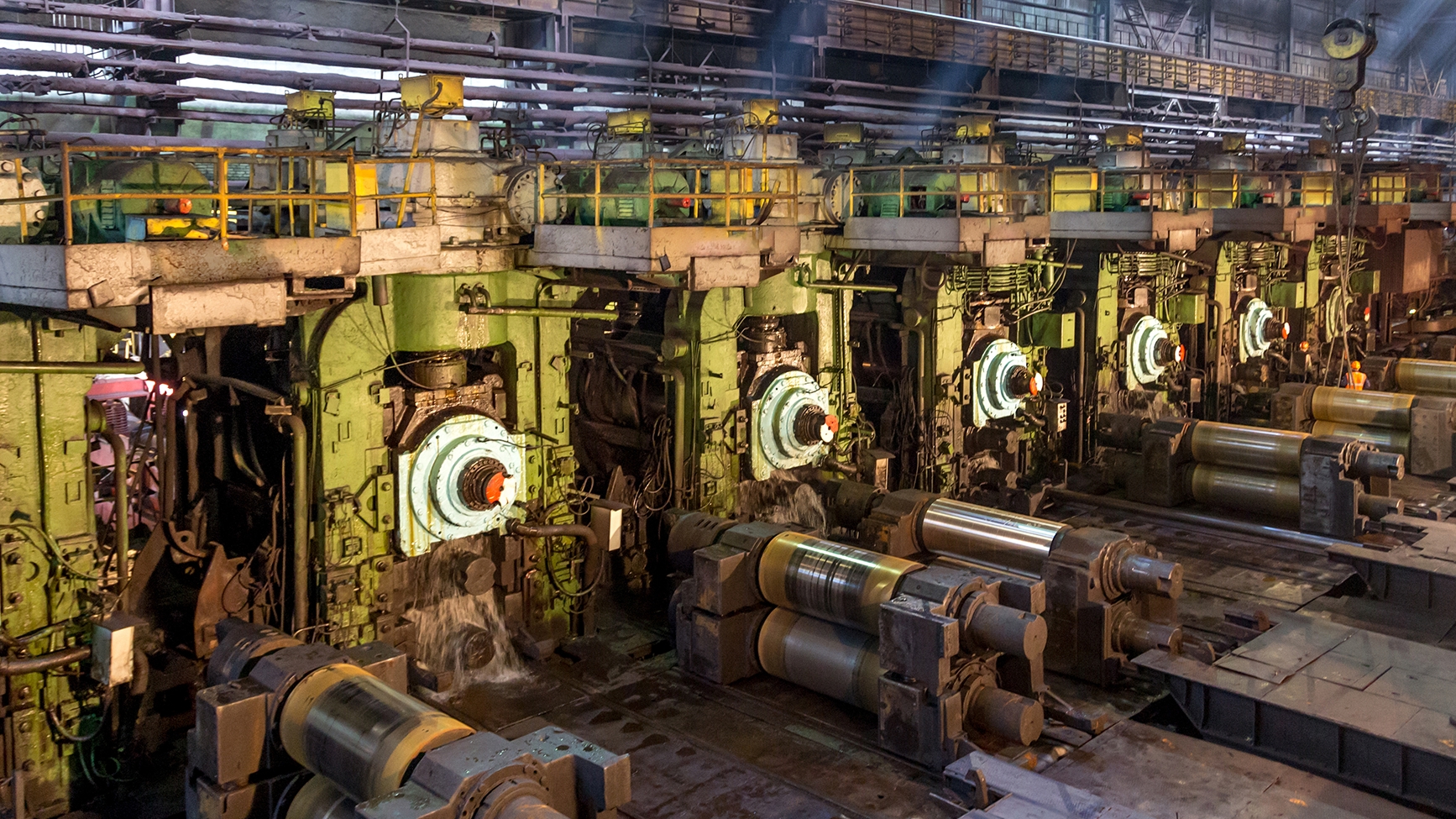

In today’s competitive landscape riddled with demand shocks, preventing the loss of production hours stemming from unanticipated equipment failures is more critical than ever before. This is especially true in steel manufacturing, where even a few hours of production stoppage can translate into millions in losses. In this candid talk, Crick Waters, SVP Enterprise at Falkonry, takes us on a journey into steel industrial transformation as he shares insights on the challenges, opportunities, and benefits of applying AI at scale.

Q: What are some of the most notable trends that you see in steel manufacturing, particularly relating to the adoption of Industry 4.0 or smart manufacturing technologies?

Crick: Despite the pandemic, the Steel industry continues to grow due to a bounceback in demand from downstream activities such as infrastructure projects, consumer products, agriculture, and process industries. 2021 witnessed an average global growth of roughly 5.8% for finished steel products, which is only expected to increase further as the global economy bounces back from Covid and the U.S. infrastructure bill starts to pump money into the economy.

This high demand has already doubled steel prices since 2019 – making every minute of production more valuable than ever. Consequently, steel manufacturers are looking at newer digital technologies to eke out process efficiencies, increase yield, and reduce costs. Thankfully, the steel industry has a headstart in digitalization because of the kinds of equipment it has deployed and the instrumentation that it already has in place.

Over the past four years, I’ve noticed that the massive amount of data generated by the industrial automation used by metals manufacturers is now being harnessed to improve operations. U.S. steel mills are currently running at 85% capacity utilization, up from around 70% in 2018. The U.S. has also spent nearly $16 billion on upgrading or building facilities since 2018. These indicators suggest there’s more ground to gain in the $2 trillion metals market.

With significant pain points such as unnecessary maintenance cycles, unplanned downtime, and quality variance, the steel industry’s big goal is to increase product availability to remain competitive. As you know, every hour of production is precious – a lost production day of a high-speed continuous caster equates to a $2-$5 million revenue loss. So, from a business perspective, in steel and metals manufacturing, the focus is on keeping all of the equipment running at all possible times.

We see a transition in the industry from merely stuffing data into a data lake to using that data to draw inferences about what actions can be taken to improve operations. The industry is going from point-specific machine models for rare events to what Falkonry is advocating to the industry – a broad purpose, all-inclusive, digitized solution, relying on AI/ML to find events of interest that require attention across all of the assets.

Q: What are some of the challenges commonly faced by steel manufacturers, and how are leaders in this space overcoming these challenges?

Crick: One of the biggest challenges for steelmakers is recognizing that forensic methods cannot be scaled. Using forensic analytics tools to understand events post-mortem is cost-prohibitive and time-consuming because of human involvement. Instead, relying on real-time inference from operating conditions is significantly more valuable compared to performing human forensic analysis after an event of interest has already occurred. The emergence of AI – and more importantly productized time series AI – is leading to a recognition that insight into continuous real-time manufacturing operations can be automated and automated at scale. This brings us to the next challenge: access to real-time operational insights. A typical integrated steel manufacturer might have 36,000 assets critical to operations and another 100,000 non-critical assets. This complexity and scale results in human teams always chasing after-the-fact explanations – they simply cannot watch all assets all the time or diagnose asset behaviors while they are in use. Time series AI on the other hand can continuously observe all the operating parameters from assets at the line and plant level thereby being the “eyes and ears” for human operations teams. AI makes it possible for operations teams to keep an eye on the whole plant as it operates and respond to events of interest at the earliest, leading to timely and informed interventions. There are other key challenges in steel industrial transformation such as the much-talked-about POC purgatory problem, limited buy-in from the operations team, and data integrity issues. These are explained in detail here: AI implementation challenges in steel manufacturing. If you are interested in learning how to overcome these challenges, be sure to read this blog. Concepts such as model churn, organizational structure and information flow, actionable insights, and people-led processes are discussed in-depth.

Q: Speaking of AI adoption at scale, can you give an example of how Falkonry has applied AI at scale, and what are some of the requirements of succeeding at scale?

Crick: When we talk about scale, we’re talking about two things: First is scaling machine learning, which computers are good at. The second is scaling the insights generated by a time series AI platform to an actionable set of insights – that’s challenging. One expects most operations-impacting conditions to evolve with time and few to be instantaneous. Because most conditions emerge with time, a time series AI platform watching tags at the line level can discover conditions needing plant attention as they emerge over time.

To make this scale of information consumable, a comparison of operating states can be auto-generated from one shift to the next, or from one week to the next. In this way, visibility into a production line can be provided to the operations team, including alerts of individual components or systems within that line that need attention. Falkonry advocates thinking big, starting small, going fast when it comes to scaling. With this approach, Falkonry’s platform scaled to deliver over 430 million assessments annually in just two years for one of our steel customers. That’s a massive amount of data being processed and put to actionable use in a very short amount of time.

Scaling requires confidence in the potential that can be realized by AI at scale and the commitment of people and resources to achieve it. Backing from all levels of an organization is required – from executives to the operational managers on the shop floor. All stakeholders need to be aligned.

Q: What’s next for machine learning and AI in the steel industry?

Crick: Sustainability is becoming an incredibly important topic. Today, many steel companies have set aggressive sustainability targets for lowered greenhouse gas emissions and vastly improved efficiencies to reduce environmental impact. Falkonry’s time series AI platform can provide metrics of greenhouse gas emissions related to production operations at a plant, line, and component level. The information contained in operating parameters enables the real-time calculation of equivalent greenhouse gas emissions and how changes in plant operations impact them.

Leveraging Falkonry’s time series AI platform using real-time operating parameters, two benefits can be delivered: understanding the health of operating assets while also reporting their equivalent greenhouse gas emission “as operated.” The actual equipment behavior is then, by definition, correlated with greenhouse gas emission quantities. This correlation allows answering sustainability questions such as: If the plant operates in one particular mode or another, what is the resultant greenhouse gas emission rate? When processes are altered somehow, what kind of deviations in emissions occur? Or if a greenhouse gas emission excursion occurred, what was the behavior of the equipment, and which parts of the asset lines were correlated with those excursions?

Q: Where should someone go if they want to get started with Falkonry?

Crick: The Falkonry website is a good place to start. The Resources section on the website provides detailed case studies where Falkonry time series AI has been successfully applied, resulting in a great deal of business value. You can also read this blog which delves into how steel manufacturers are able to increase productivity, reduce wastage and improve quality by using time series AI in their finishing lines.

Next, you can have a discussion with Falkonry to identify a target area using business metrics and inputs from ops personnel. A plan is created listing assets to be monitored, which signals (tags) will be used, and what data architecture will be put into place. Next, the important task of aligning stakeholders begins which involves operations buy-in and support from the executive levels. The transformation begins by connecting plant-level assets (PLCs/SCADA/Historians etc) to the time series AI platform. The entire process is streamlined with the aim of the fastest possible time-to-value.

If you’re looking for a more general understanding of time series AI and the challenges of implementing a machine learning-driven reliability program, this blog makes for an interesting read. The resources section includes a number of great panel discussions on similar topics, including this fireside chat with a leading American steelmaker.