Show Categories

Latest Posts

Predictive Operations in Food and Beverage

It is crucial that a F&B manufacturer enables predictive maintenance and predicting quality issues to cope with fluctuating demand and lower costs

Interview with Ian Hersey: DoD’s push for digitalization and CBM+

The U.S. DoD is pushing for digitalizaton through machine learning. A key area of focus is to improve asset readiness and performance

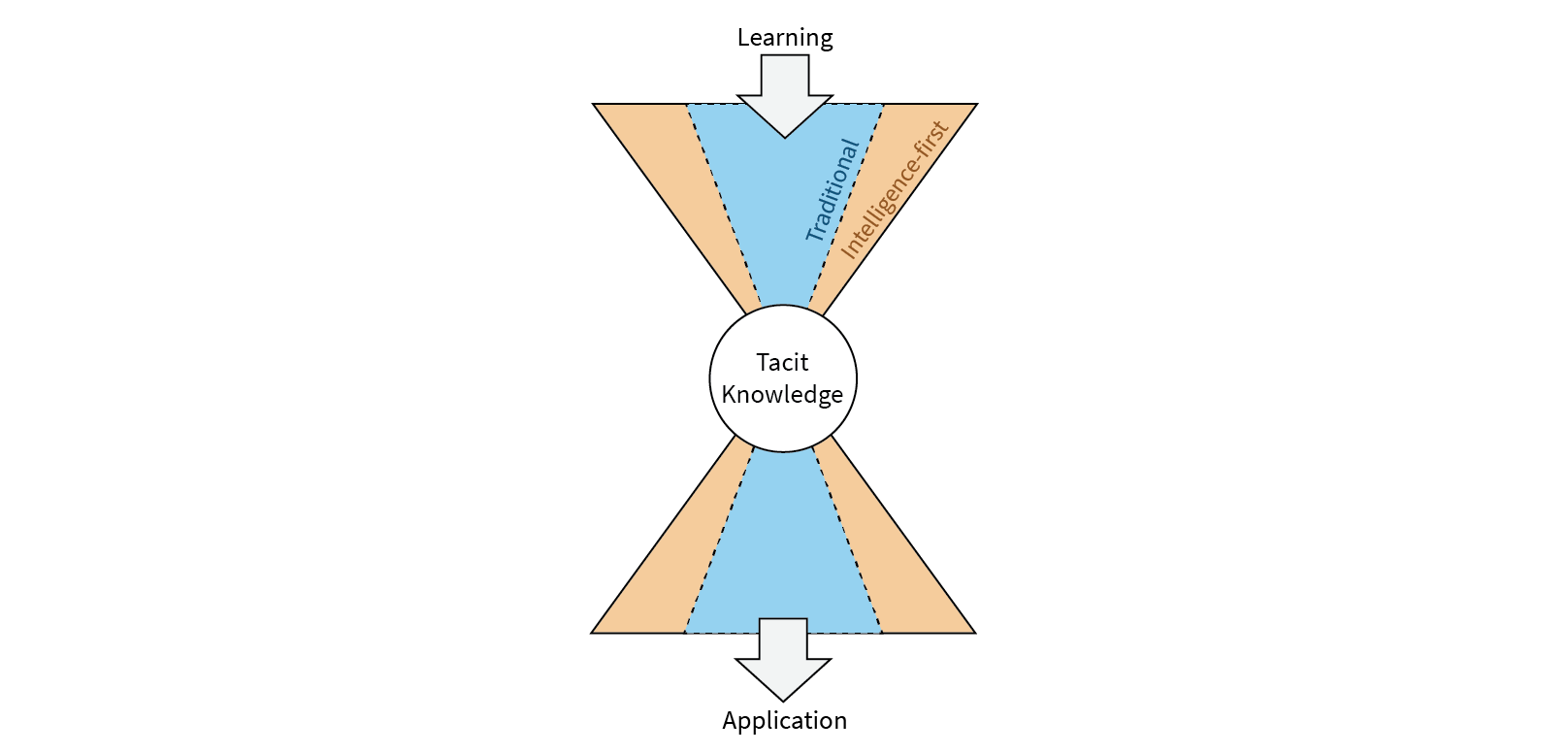

How Intelligence-First Leads to Faster Learning and Cost-Effective Scaling

The intelligence-first approach to machine learning captures human knowledge and expertise leveraging it for quicker and cost-effective scaling

Machine Learning: The Natural Form for Capturing Tacit Knowledge?

Intelligence-first is a low cost machine learning (ML) approach to capture an expert's tacit knowledge i.e. the knowledge gained from examples