Show Categories

Latest Posts

Generate AI results with Falkonry AI Cloud and Litmus UNS

Litmus UNS and Falkonry Time Series AI Cloud, offer easy accessibility of operational data without coding and IT effort, enabling AI insights into machine health, process health, etc.

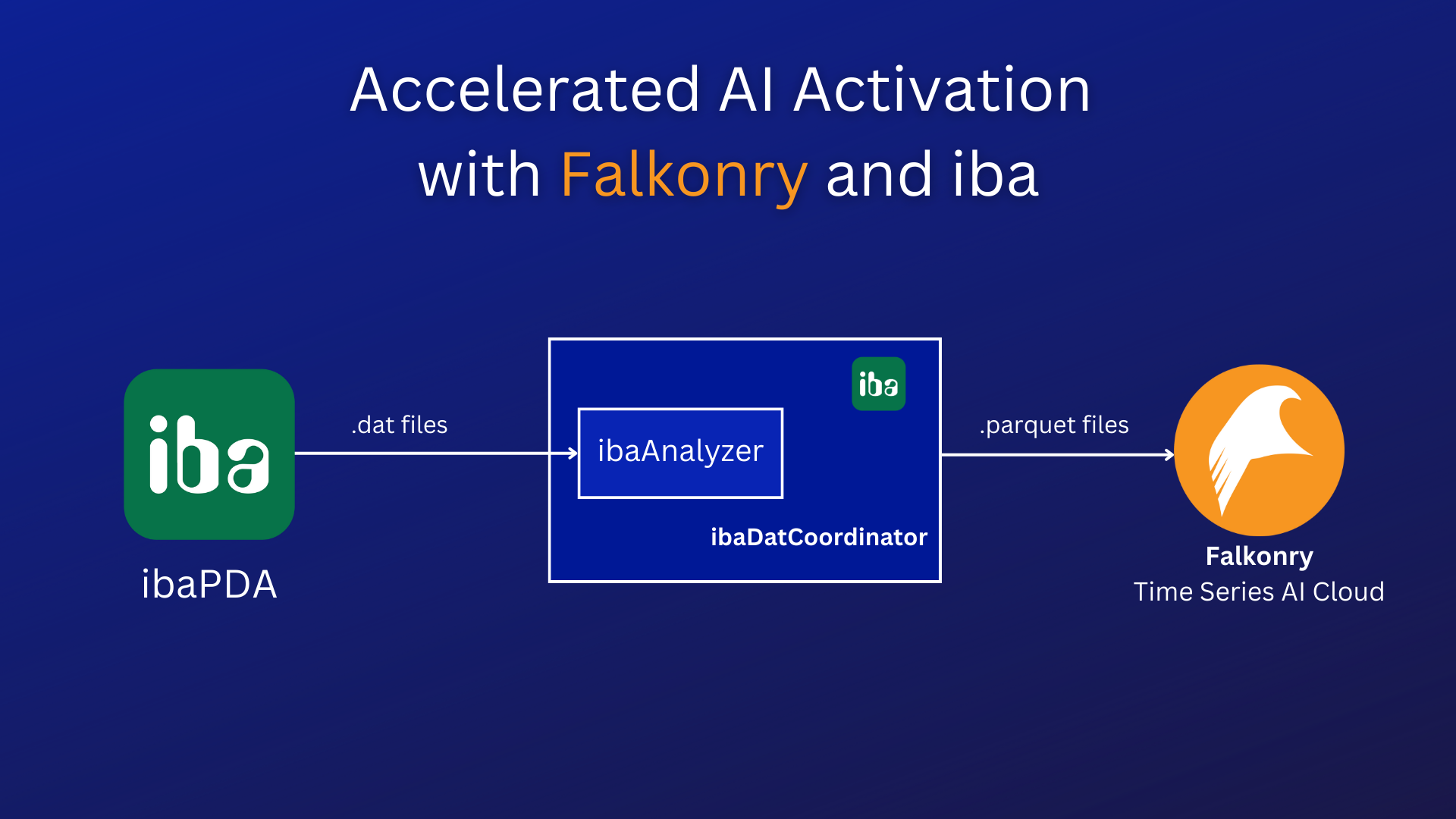

Accelerated AI Activation: The Seamless Integration of iba and Falkonry

By combining Falkonry AI with iba Systems, industrial organizations can put their data to work without changing the existing infrastructure.

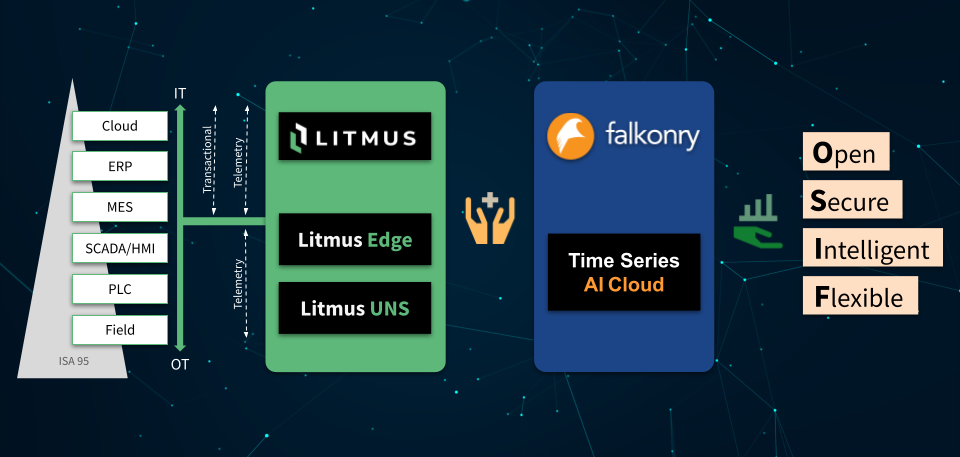

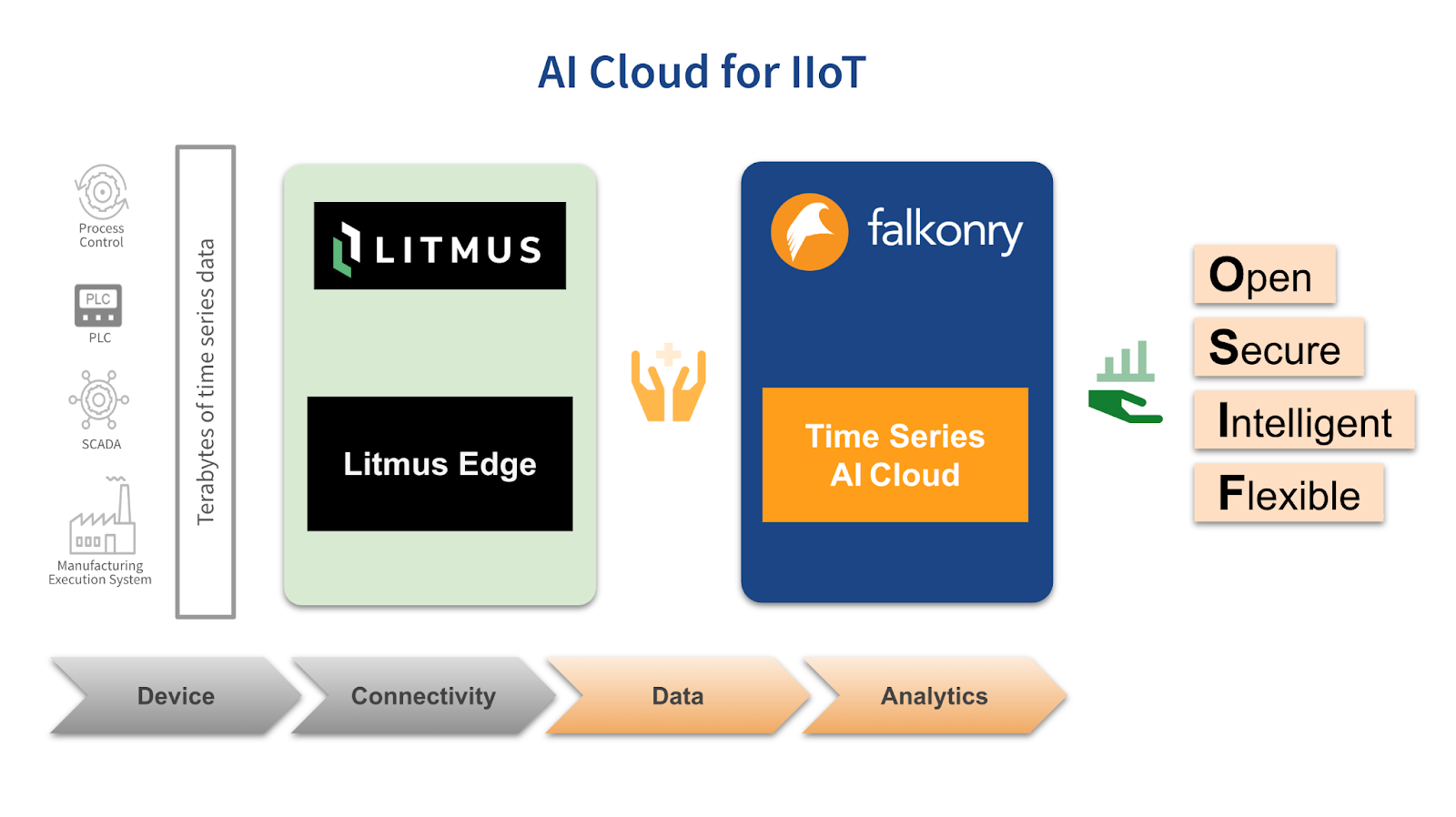

Falkonry’s AI Cloud for IIoT with Litmus can get you Smart results

Open, Secure, Intelligent, and Flexible: How Falkonry’s AI Cloud for IIoT with Litmus can make your Manufacturing Operations Smart

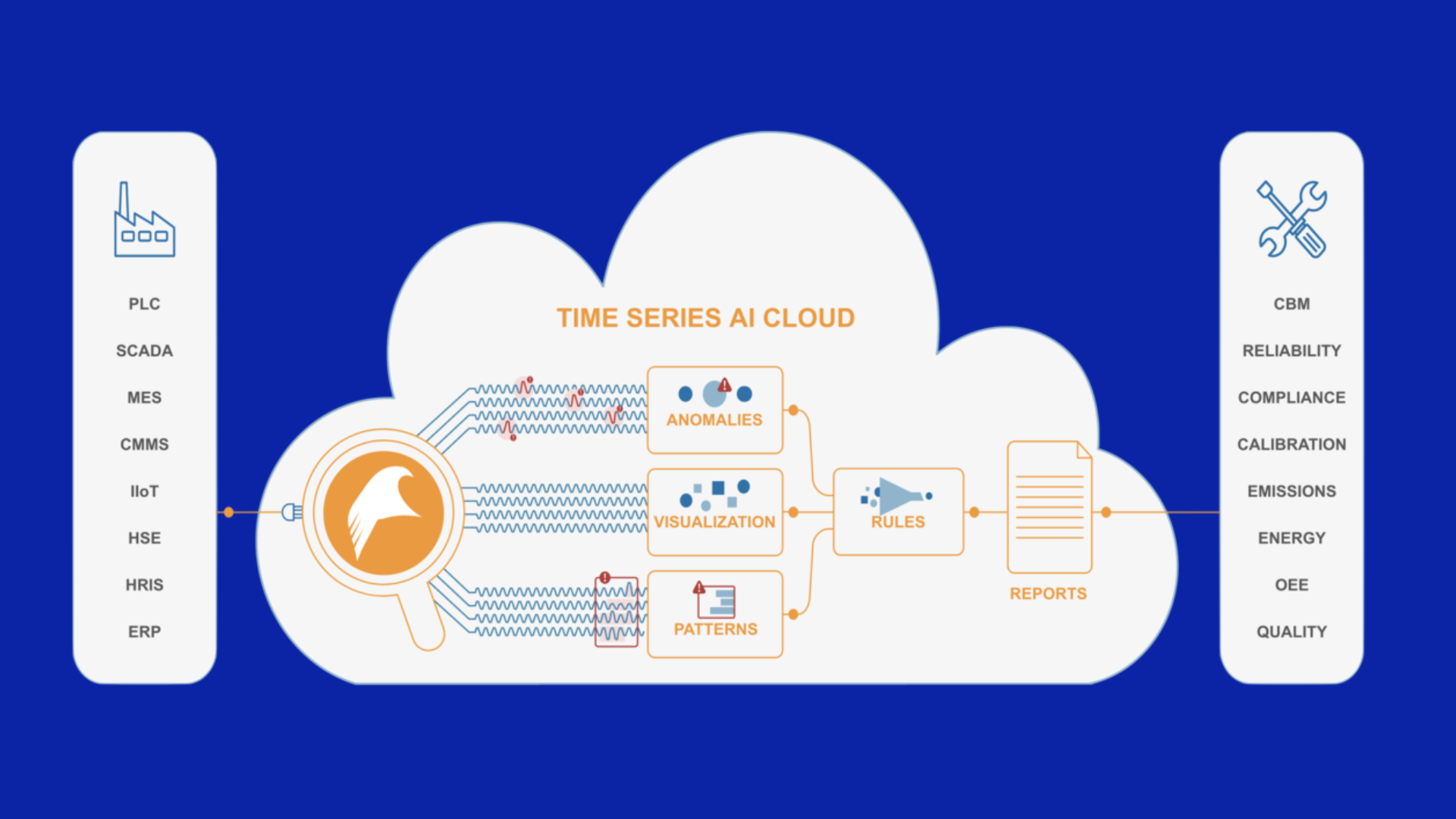

Time Series Data + AI + Cloud

Learn how seamless integration of time series data and AI anomaly detection drives actionable insights, revolutionizing industrial operations

Predictive Operations in Food and Beverage

It is crucial that a F&B manufacturer enables predictive maintenance and predicting quality issues to cope with fluctuating demand and lower costs

Interview with Ian Hersey: DoD’s push for digitalization and CBM+

The U.S. DoD is pushing for digitalizaton through machine learning. A key area of focus is to improve asset readiness and performance